WATER DAMAGE, ROOF LEAKS, PIPE BREAKS, FIRE, FLOOD, MOLD, WIND, HURRICANE, THEFT & VANDALISM

A PROFESSIONAL ADJUSTER WILL CONTACT YOU IMMEDIATELY

Life is filled with unforeseeable events, such as a fender-bender on the way to work or sudden water damage at home. In these situations, it's important to know that you can rely on your insurance policy to protect you.

South Florida Public Adjusting Services helps you work through all the technical details of the insurance claim process to make sure that you are property covered and compensated for your loss.

We have the knowledge and experience to properly represent our clients in all types of residential and commercial claims, regardless of the size or type of loss.

It is important to work with a company that is reliable and reputable who can make sure that you are kept fully up to date with the entire process and ensures that your claim is maximized and proper settlement is achieved.

Miami Herald: PUBLIC ADJUSTERS LAND LARGER SETTLEMENTS!

From the Miami Herald on January 15, 2010:

The Miami Herald quoted an audit that was conducted recently by the Florida Legislature has found that it is clearly within the policy holder's interest to hire a Public Adjuster to represent them during the claim process.

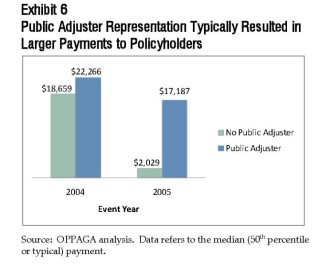

The numbers quoted by the article were quite shocking and beyond even my own expectations. To put it plain and simple, the article stressed that in comparing claims filed with Citizens Insurance, those using a Public Adjuster received 574% more than those not using a Public Adjuster and, furthermore, those numbers increased to 747% more on catastrophe claims such as those filed in 2005 for Hurricane damage.

To read the actual report, click here:

http://www.oppaga.state.fl.us/Summary.aspx?reportNum=10-06

NOW THAT YOU HAVE THIS INFORMATION, PICK UP THE PHONE AND CALL US TODAY!

News Archives - Claims Journal

Missouri House Backs Legal Shield for Weedkiller Maker Facing Cancer Lawsuits (Fri, 26 Apr 2024)The manufacturer of a popular weedkiller won support Wednesday from the Missouri House for a proposal that could shield it from costly lawsuits alleging it failed to warn customers its product could cause cancer. The House vote marked an important …

>> Read more

Class Action Opposes Limiting Ship’s Liability for Baltimore Bridge Collapse (Fri, 26 Apr 2024)

A Baltimore small business has filed a class action against the owner and operator of the cargo ship Dali that crashed into the Francis Scott Key Bridge last month. The suit, filed Thursday by the Karen Austin, the founder of …

>> Read more

HSBC Wins $1.6 Billion Suit Over Disney Film Finance Scandal (Fri, 26 Apr 2024)

HSBC Holdings Plc successfully fought off a London court claim brought by a group of investors in a £1.3 billion ($1.6 billion) lawsuit over tax breaks linked to Walt Disney Co. film financing. The bank faced allegations that it misled …

>> Read more

Report: Cybercrime ‘A Thriving Business,’ as U.S. Claims Frequency Rises (Fri, 26 Apr 2024)

Cyber claims frequency in the U.S. rose 13% last year, a new report shows. Coalition this week released its 2024 Cyber Claims Report, which includes data and case studies from organizations across the country. The report portrays cybercrime as “a …

>> Read more

Chubb CEO Greenberg: Some Financial Lines Underwriting Practices ‘Simply Dumb’ (Fri, 26 Apr 2024)

According to Chubb CEO Evan G. Greenberg, the insurance industry’s underwriting practices for a number of financial lines are “simply dumb.” In a call with analysts to discuss Chubb’s earnings for the first quarter, Greenberg said rates for financial lines …

>> Read more

Should I Hire An Attorney or A Public Adjuster?

Here is a really good video that explains when to use a Public Adjuster and when to use an Attorney to handle your insurance claim. I would say that in almost 95% of situations, you would use a Public Adjuster before an Attorney.

Attorney's usually do not understand how to adjust a claim or speak the same language as adjusters. Rather, an Attorney is necessary when a claim is denied and cannot be re-opened or if all options under the policy have been exhausted and you are still not happy with the outcome.

IN CONCLUSION, HIRE A PUBLIC ADJUSTER TODAY!

Hurricane Wilma: Is It Too Late To File A Claim Or Re-Open My Claim?

The simple answer to this question is NO!

You have up to five years to file a claim and/or re-open a previously filed claim. Since Hurricane Wilma took place on October 24, 2005; you technically have until October 24, 2010 to notify the Insurer Carrier you had at the time of Wilma that you would like to file a claim and/or are interested in re-opening a claim.

I will be cautious to advise that this is not a quick and easy process. Additionally, there are certain insurance companies, such as POE, that are no longer in business and it is too late to file a claim or re-open a claim with such carriers.

However, if you have documentation, invoices, pictures, receipts, etc. for the monies expended and evidence of the damaged that occurred, you are in a much better position.

Give us a call today so we can assist you with this process. Our team of professionals are trained and experienced in dealing with such claims.